2024 Home Office Deduction

2024 Home Office Deduction – The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount. .

2024 Home Office Deduction

Source : news.yahoo.com

Home Office Deductions Tax Tips YouTube

Source : m.youtube.com

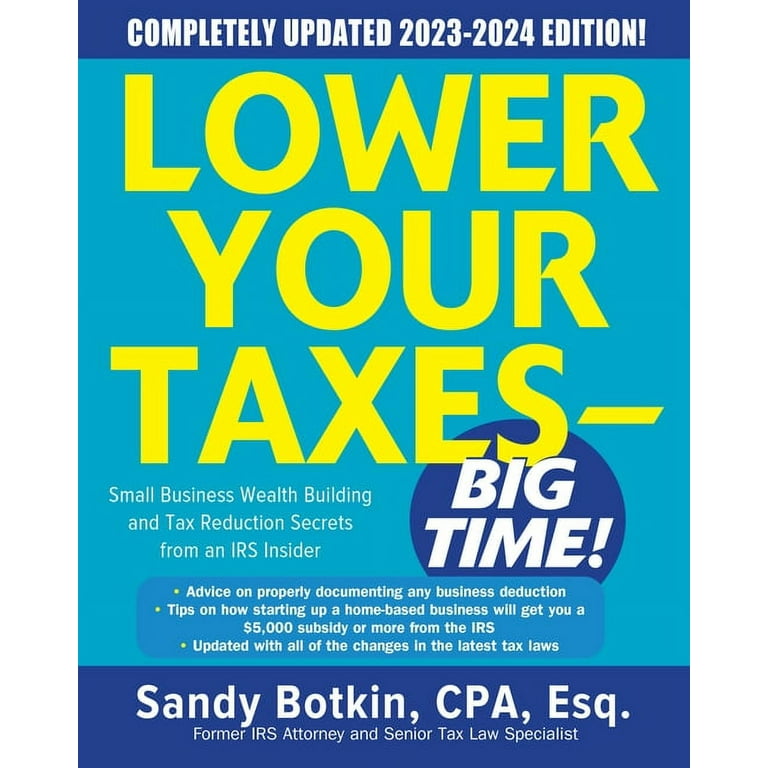

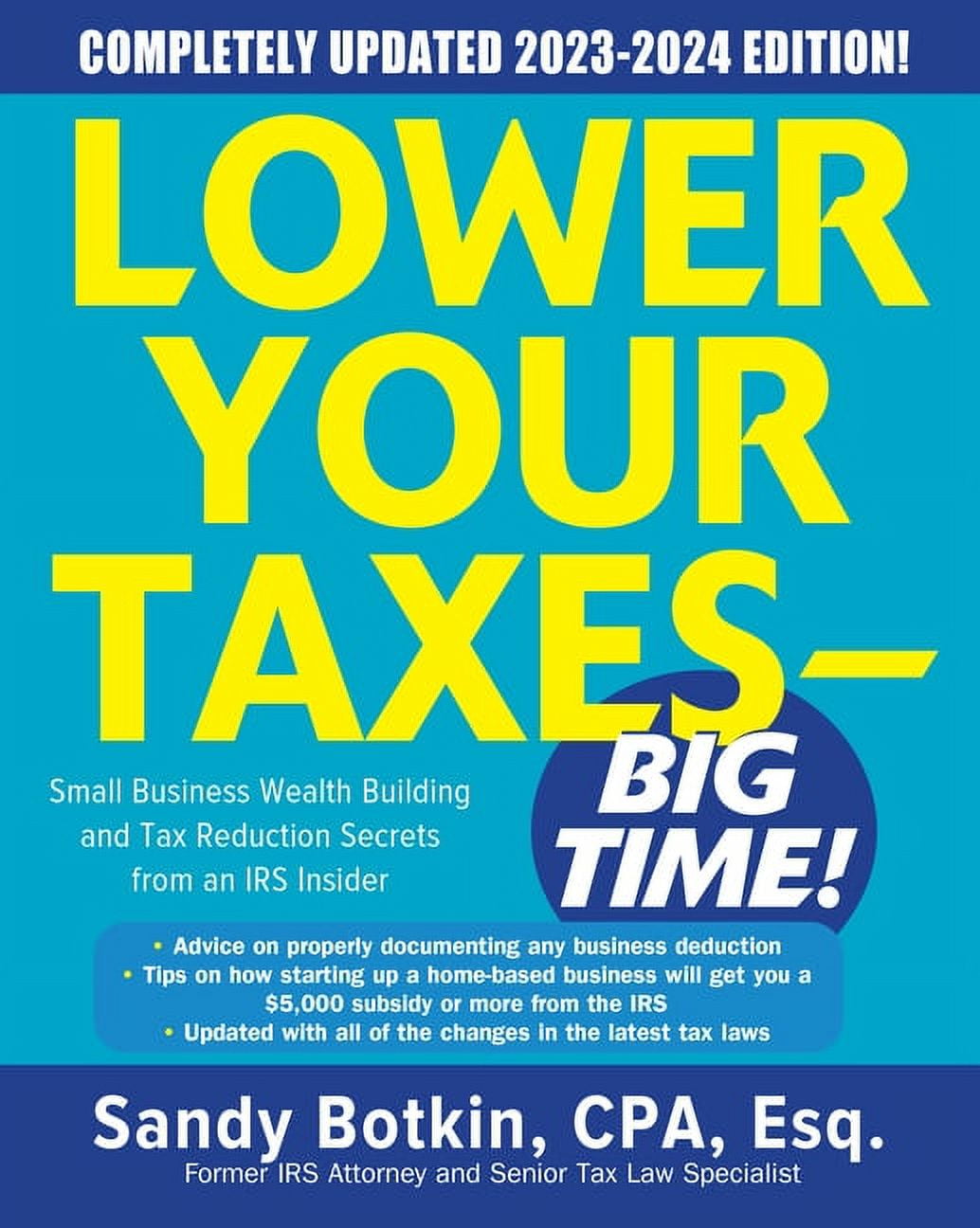

Lower Your Taxes Big Time! 2023 2024: Small Business Wealth

Source : www.walmart.com

Lower Your Taxes BIG TIME! 2023 2024: Small Business Wealth

Source : www.amazon.com

Lower Your Taxes Big Time! 2023 2024: Small Business Wealth

Source : www.walmart.com

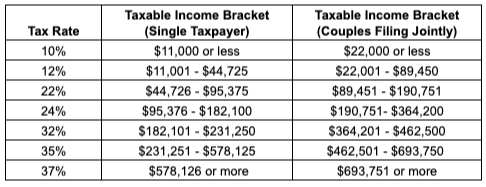

These Are the New Federal Tax Brackets and Standard Deductions for

Source : www.barrons.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Lower Your Taxes BIG TIME! 2023 2024: by Botkin, Sandy

Source : www.amazon.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

2024 Home Office Deduction IRS announces 2024 income tax brackets – see where you fall: With respect to the 20% deduction for qualified pass-through income, for 2024, the threshold amount at which the “specified service trade or business” phaseout and the wage (or wage+property) . In 2023 (taxes filed in 2024), the use part of your home regularly and exclusively for business-related activity, the IRS lets you write off certain self-employment deductions for associated .